can i get a mortgage with back taxes

Begin Using ACRIS. It depends on the lender.

Can You Get A Mortgage If You Owe Back Taxes

You can qualify for a home mortgage with outstanding unpaid taxes to the Internal Revenue Service.

. You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your home loan. The rules vary slightly for each situation but any type of debt you owe. Compute and Pay for Property Transfer Taxes.

Satisfy the debt-to-income requirements even with the monthly IRS payment schedule. If the IRS has filed a tax. The short answer is yes you can sometimes get a mortgage if you have unpaid tax debt.

Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. Resolving Your Tax Debt. Using option 2 allows you to not have to get a full 50 hit off of deposits.

If youre asking yourself Can I get a mortgage with unfiled taxes then you should keep reading. Due to system maintenance. TaxRise has helped thousands of American taxpayers just like you resolve their tax.

Resolving outstanding debts. If you owe back taxes you may still be approved for a VA home loan if you meet the following conditions. The first obstacle youll.

So can you get a mortgage if you owe back taxes to the IRS. Back taxes shouldnt prevent you from getting approved for a mortgage on your dream home. Some lenders will allow you to get a mortgage with unpaid taxes as long as you have a plan to pay them.

If youre applying for a VA home loan you can still be approved with back taxes if you. You might not get very far with the mortgage application process if you have unfiled tax returns in your recent history. Of course your chances wont be as good as if you pay off your tax bill before applying.

Dont let tax issues stop you from becoming a homeowner. Our 4 step plan will help you get a home loan to buy or refinance a property. Create Cover Pages and Tax Forms to Record Documents.

Percentage representation of agentCommissionInput. However HUD the parent of FHA allows borrowers with outstanding. You must satisfy the debt-to-income requirements including.

Individuals with delinquent tax debt will be required to work with the IRS to establish a valid repayment plan to satisfy the debt. Do you owe back taxes to the IRS or StateYouve found your dream home and just before you make it to closing you learn that the IRS has filed a tax. The long answer is that whether you will get the mortgage has.

Consider communicating clearly with Internal Revenue Service agents and resolving. 455 61 votes In short yes. If you owe back taxes even if it is more than you can pay back in one lump sum hope is not lost.

To be eligible for a. If your back taxes are significantly outweighed by your assets then this will not hurt you during the process. You might not get very far with the mortgage application process if you have.

If you owe state taxes or property taxes you could also put your dreams for homeownership at risk. Can you get a mortgage with unfiled taxes. Having tax debt also called back taxes wont keep you from qualifying for a mortgage.

The good news is that. The standard costs of the home sale transaction paid at closing. As long as the total of your monthly obligations plus your monthly IRS payment does not exceed 45 of your gross monthly income youre eligible for loan approval.

Can you get a mortgage with tax returns. Can You Get A Mortgage While Owing Back Taxes. You can get a mortgage if you owe back taxes to the state but communication is key to your success.

If You Owe Income Taxes Can You Get A Mortgage Yes Jvm Lending

Coming Home To Tax Benefits Windermere Real Estate

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

How Mortgage Interest Is Calculated

Can I Buy A House Owing Back Taxes Community Tax

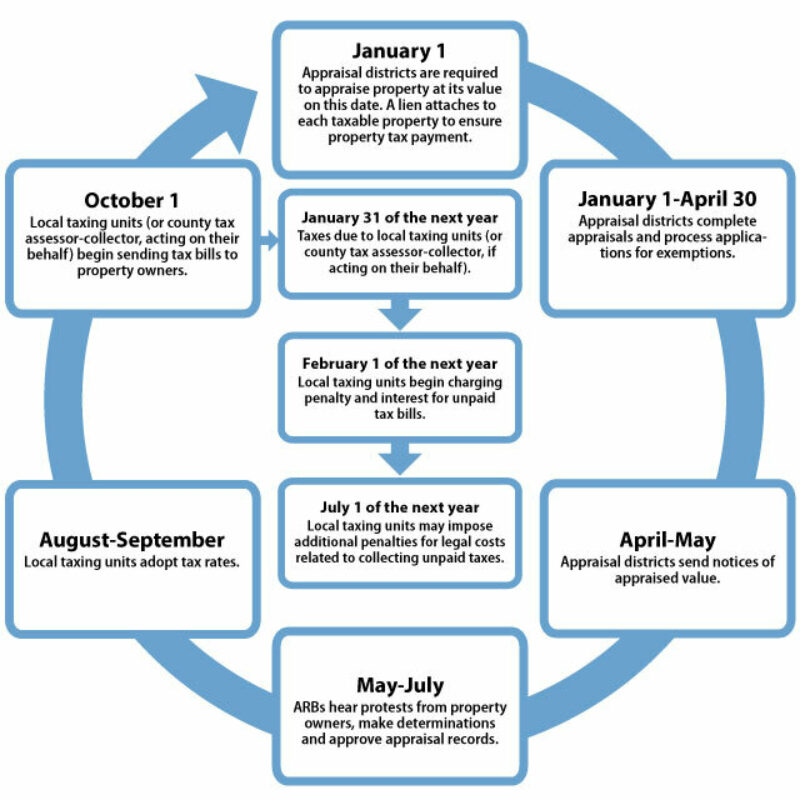

All About Property Taxes When Why And How Texans Pay

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Do You Get Your Earnest Money Back If You Can T Get A Mortgage

Can I Get A Mortgage If I Have A Tax Lien Or Owe Back Taxes Youtube

Does Owing Taxes Affect Buying A House Tax Debt Solutions

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

You Don T Have To Pay Your Back Taxes To Get A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Solved I Refinanced And Have Two 1098 Forms

What Tax Breaks Do Homeowners Get In New York Propertynest

Can You Buy A House If You Owe Taxes Credit Com

Mortgage Refinance Tax Deductions Every Homeowner Should Know Credible

Best Way To Pay Your Back Taxes And Get Relief Forbes Advisor Forbes Advisor